coweta county property tax office

Search Coweta County property tax and assessment records by address owner name parcel number or legal description including sales search and GIS maps. Glynn County Property Appraisal Office Harold Pate Annex Building 1725 Reynolds St 1st Floor Brunswick GA 31520 Phone 912554-7093 Fax 912267-5723.

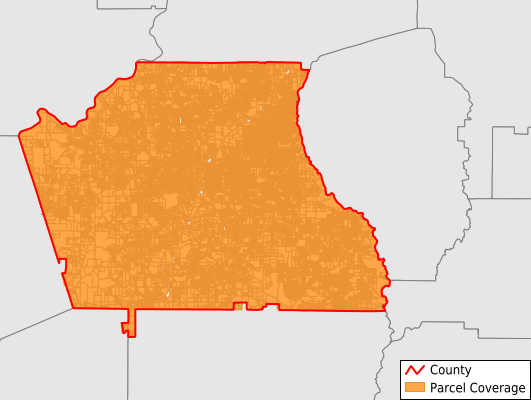

Geographic Information Systems Gis Coweta County Ga Website

Inventory of goods in the process of manufacture or production which shall include all partly finished goods and raw materials.

. The goal of the Coweta County Tax Assessors office is to annually appraise at fair market value all tangible real and personal property located in Coweta County by utilizing uniform methods and. Colorado is ranked 1023rd of the 3143 counties in the United States in order of the median amount of property taxes collected. The median property tax in Denver County Colorado is 1305 per year for a home worth the median value of 240900.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Denver County collects on average 054 of a propertys assessed fair market value as property tax. Filing a property tax return homestead exemptions and appealing a property tax assessment.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. The information is as accurate and up to date information as possible.

This section provides information on property taxation in the various counties in Georgia. Contact the Personal Property Division of the Tax Assessors office at 770-254-2680 for specific information and filing requirements. The gov means its official.

Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session. Cook County collects on average 138 of a propertys assessed fair market value as property tax. 48-4-5 excess funds may be claimed by the record owner of the property at the time of the tax sale by the record owner of each security deed affecting the property and by any other party having any recorded equity interest or claim in such property.

The Coweta County version of Freeport differs slightly from the state version. The information provided is for tax purposes only and not legally binding. Local state and federal government websites often end in gov.

Following a tax sale any overage of funds known as excess funds is placed in a separate account.

Coweta County Ga Hallock Law Llc Property Tax Appeals

Coweta County Government 2 22 2022 Coweta County Board Of Commissioners Meeting Facebook

Coweta Tag Office Closed Due To Covid 19 Winters Media

Pre K Lottery Registration Resumes May 26 The Newnan Times Herald

Best No1 Coweta County Tax Assessor Lawyer

C D Landfill Coweta County Ga Website

Coweta School Board Approves 2021 22 Budget Winters Media

Coweta County Government 2020 Notices Of Assessment 2020 Notices Of Assessment Were Mailed On Friday June 26 2020 The 2020 Noa Is The Culmination Of A Three Year Revaluation Project For All

Senior Services In Coweta County Coweta County Ga Website

Coweta Living 2017 2018 By The Times Herald Issuu

Coweta County Georgia Gis Parcel Maps Property Records

Confederate Statue Damaged Outside Coweta County Courthouse